Accumulated depreciation formula

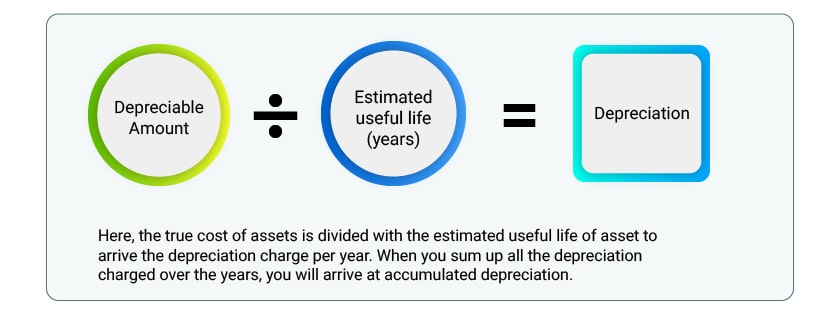

You can calculate this by dividing the difference between the asset cost and its expected salvage value by the number of years you expect the item to be operational. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Finally dividing this by 12 will tell you the monthly depreciation for the asset.

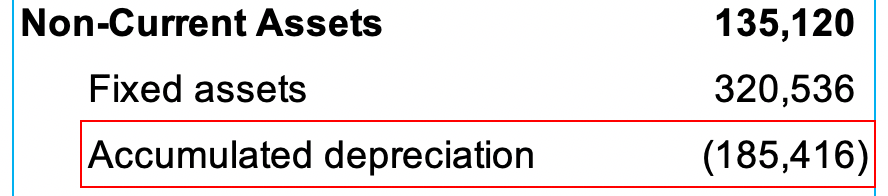

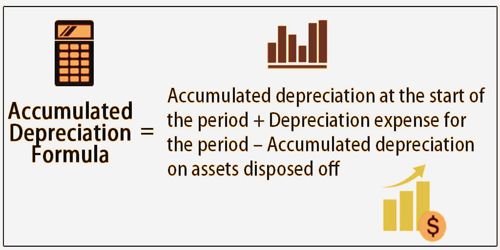

. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD. Determine the useful life of the.

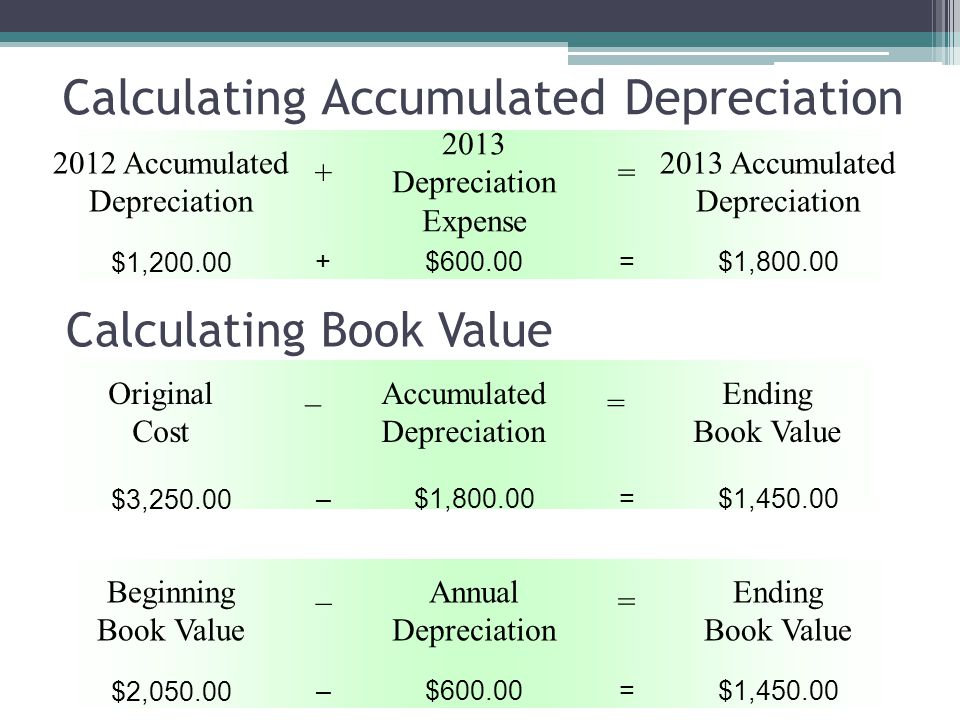

Annual depreciation Total depreciation Useful lifespan. Accumulated depreciation for the desk after year five is 7000 1400 annual depreciation expense 5 years. Depreciation Expense 2 x Basic Depreciation Rate x Book Value.

Accumulated depreciation Depreciation expense Depreciated amount Depreciation expense in this formula is the expense that the company. Subtract salvage value from the original cost Knowing the salvage value of the. Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation can also be calculated by taking the.

One of the most common is known as the straight-line method. Accumulated Depreciation Definition and Example. Subtract the assets salvage value from its total cost to determine what is left to be depreciated.

A fixed asset like a vehicle or machinery loses value every year until the end of its useful life. That loss in value is called. How to calculate accumulated depreciation formula Straight-line method.

Why Is Accumulated Depreciation a Credit Balance. Determine the cost of the asset. Here is the formula for calculating accumulated depreciation using the double-declining balance method.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. The simple formula for accumulated depreciation is. Double declining balance depreciation 2x straight-line depreciation rate x remaining book value Read more.

Use the following guide to calculate accumulated depreciation with the straight-line formula. The straight-line method for. Monthly depreciation Annual.

The equipment has a residual value of 20000 and has an expected useful life of 8 years. Annual Accumulated Depreciation Depreciable Base Inverse Year Number Sum of Year Digits Company ABC purchased a piece of equipment that has a useful life of 5. There are a few different methods for calculating accumulated depreciation.

Accumulated depreciation formula Accumulated Depreciation Balance Beginning Period AD Depreciation Over Period End Period AD Read more about Bank reconciliation statement. On December 31 2017 what is the balance of the accumulated depreciation account. The formula for double declining balance depreciation is.

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Explained Bench Accounting

Accumulated Depreciation Definition Formula Calculation

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition How It Works Calculation Tally

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Calculation Journal Entry Accountinguide

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Overview How It Works Example

Depreciation Expense Double Entry Bookkeeping

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Assignment Point

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Calculator Download Free Excel Template

Units Of Production Depreciation

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Accountingtools India Dictionary